Please visit the new RISD Bond 2021 website to find answers to frequently asked questions, learn about district growth, access voting information, and more! Site visitors can submit questions from the FAQ page or reach out to the district Communications Director for additional assistance.

Click here to visit the site!*

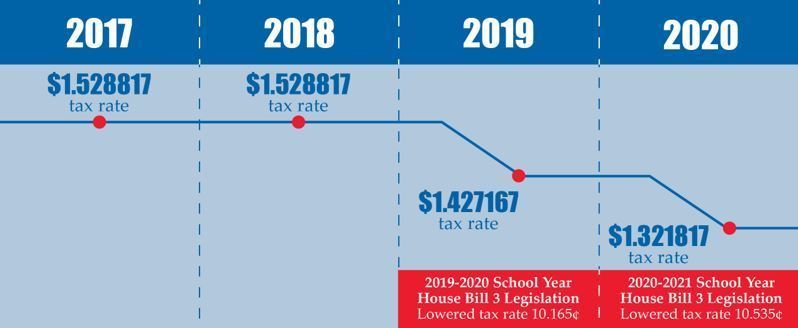

One commonly asked question is related to tax bills versus tax rates. Royal Bond 2021 is not projected to result in an increase to the tax rate, regardless of the outcome of the bond election. Let's consider an example. You've been buying the same shampoo at HEB for years. You go to HEB to replenish your supply, only to find that the item price has increased from $5.99 to $7.99. The 8.25% tax rate set by your county has not changed, but the taxable value increased by $2.00. So, buying the bottle at $7.99 results in a taxable value increase, but NOT an increase in the tax rate. Royal ISD's tax rate has not changed. In fact, the tax rate has decreased by 10.1 cents in recent years. What HAS changed is the value set for each property by the Waller County Appraisal District.

*Special thanks to RISD senior Alexis Ibarra for his help with the bond website during his summer PR internship!